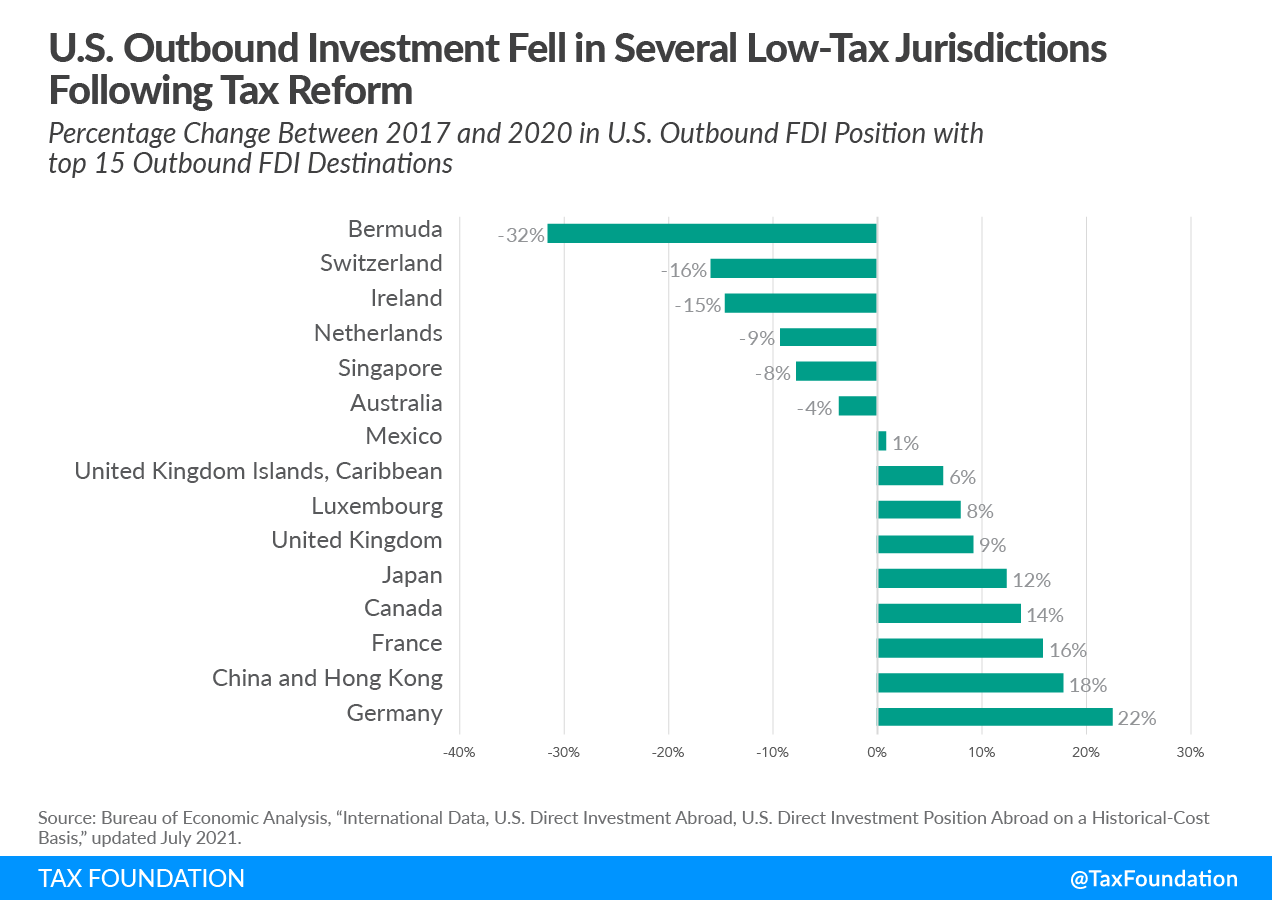

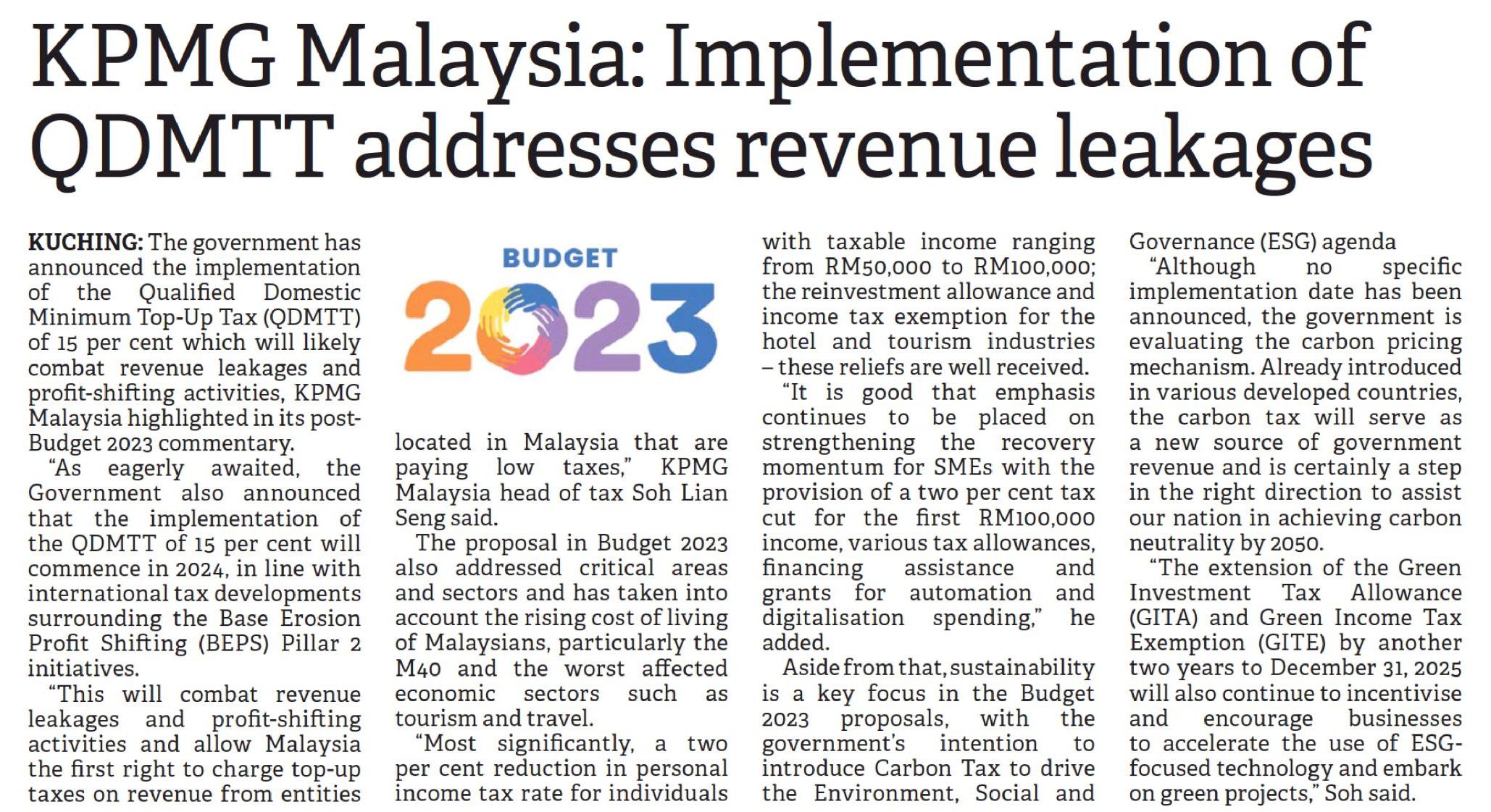

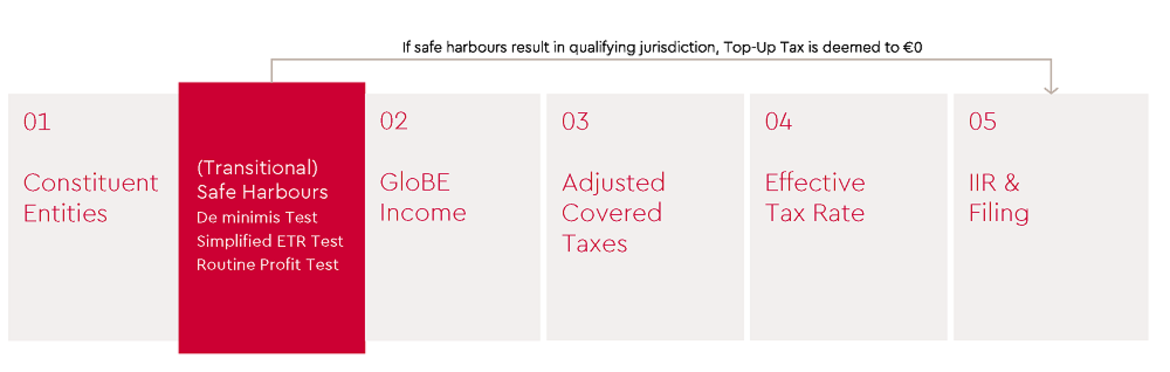

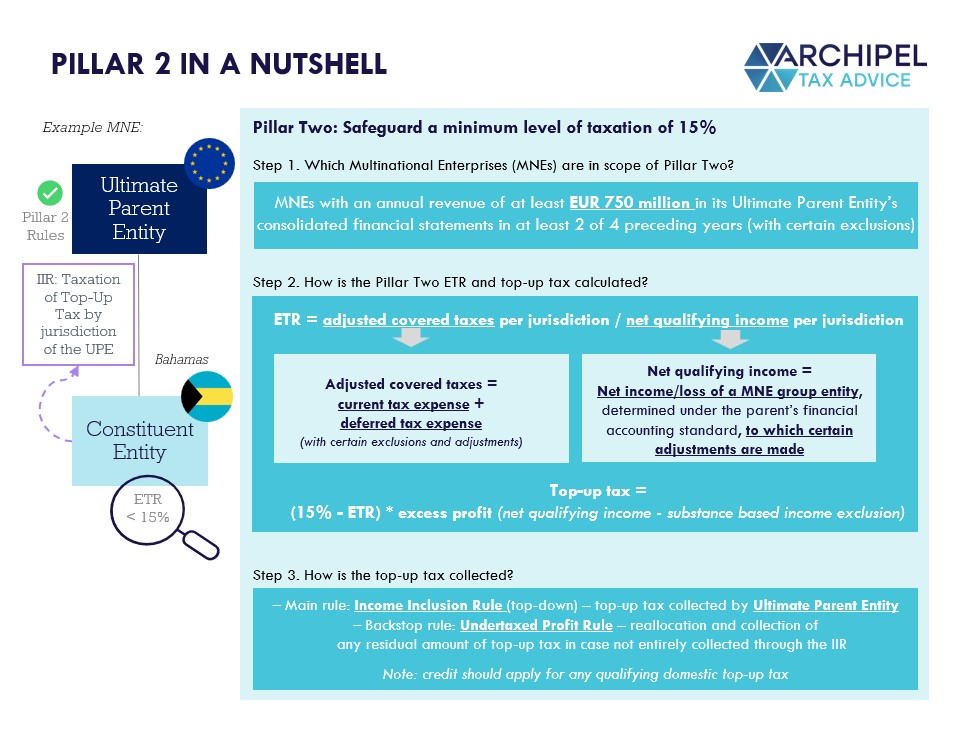

KPMG Malaysia - Malaysia's Ministry of Finance is considering the introduction of a Qualified Domestic Minimum Top-up Tax (QDMTT) under the Global Anti-Base Erosion (GloBE) Rules of Pillar Two. Simply put, the

International - Pillar Two: OECD Inclusive Framework releases Administrative Guidance on the GloBE Rules